ESG-Conscious Investment-Grade Bond Mandate (SMA)

Objective & Approach:

Launched in 2023*, the environmental, social, and (corporate) governance (“ESG”) conscious investment-grade bond mandate objective is to preserve capital and generate income by investing in bonds with good relative ESG performance and attractive coupons.

The mandate invests in approximately 30-40 fixed income securities issued by companies who have achieved good scores in a third-party ESG valuation process; for safety, the mandate may also invest in government issues. The return target is 50-200 basis points over 5-year Canadian bonds.

Institutional accounts are customized to meet compliance requirements.

Portfolio Yield to Maturity:

Portfolio Effective Duration:

Portfolio Credit Rating:

3.8% (April 9, 2025)

3.8

BBB- or higher

Key Features:

Strategy diversified by position size, industry sectors, and term-to-maturity.

Portfolio invested in fixed income securities with good relative ESG performance and attractive coupons.

Disciplined, fundamental approach to constructing investment-grade bond portfolios we believe may reward investors with capital gains due to credit improvements and credit rating upgrades.

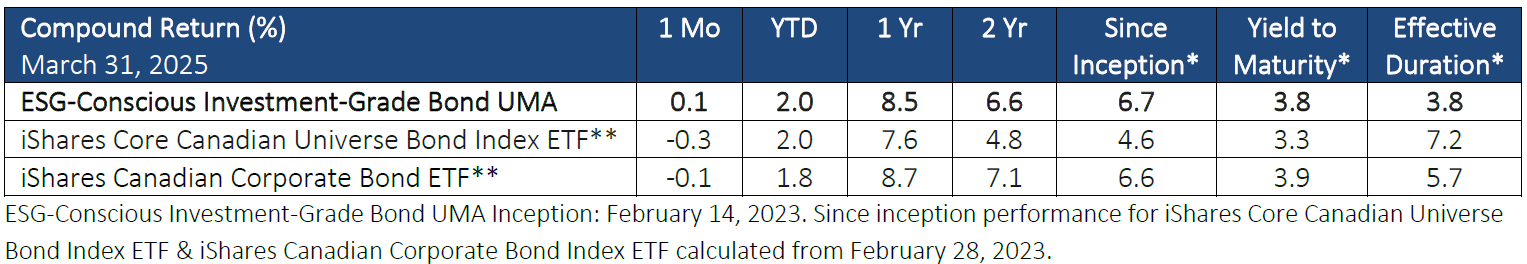

*Inception: February 14, 2023. The ESG-Conscious Investment Grade Bond Mandate is part of a Third-Party UMA Program, Goodwood Inc. acts as sub-advisor for this Mandate. See full disclosure page. Performance returns above are displayed for the founding ESG-Conscious Investment-Grade Bond UMA referencing sources believed to be reliable. All ESG Score data is collected from LSEG (formerly Refinitv Eikon) LSEG ESG Scores measure a company’s relative ESG performance based on company-reported data in the public domain across three (environmental, social and governance) pillars and ten ESG themes. Performance is not guaranteed, and past performance is not indicative of future results and may not be repeated. Performance data from certain market indices/ETFs is provided for information purposes only. These ETFs are not a benchmark of the UMA portfolio but rather are displayed for comparison purposes to the broad market.