Polaris Infrastructure: 100% Upside, And Get Paid 6% To Wait

Summary

Polaris Infrastructure operates a geothermal plant in Nicaragua with an attractive PPA already in place, a solid balance sheet, a good management team, and a long list of impressive shareholders.

The company has a runway to expand production from ~50Mw currently to over 72Mw given its current drilling program and the addition of a binary unit.

Each Mw added adds $1 million to FCF, of which 50% will be distributed as dividends in USD. This is a case where you get paid to wait.

We value Polaris at 9.5x 2016 EBITDA, which implies a share price of $17, offering 100%+ upside to the current price of $8.25.

(Editors’ Note: Polaris Infrastructure trades on the Toronto Stock Exchange under ticker symbol PIF.TO, with CAD$1.3M average daily trading volume)

Business Overview

Polaris Infrastructure (OTCPK:RAMPF, PIF.TO) is an owner and operator of geothermal plants in Latin America. The company currently operates a 72Mw plant (San Jacinto) and also owns a second project (Casita), which is a 100+Mw resource, as yet undeveloped. Polaris has a 72Mw PPA for its San Jacinto plant (which currently operates under full capacity at ~55Mw gross production).

Geothermal Power

For those unfamiliar, geothermal power is effectively hydroelectric power: underground reservoirs are drilled into, and under its own natural pressure, the hot water within rises to the surface. This rising water turns into steam as pressure decreases, and this steam is then allowed to turn turbines, producing electricity.

There are 3 primary methods to capture geothermal power: dry steam, flash steam and binary power. Dry steam is largely used in older facilities and won’t be discussed here.

Flash Steam

Flash steam plants use water which is at least 180 degrees Celsius, which limits their use to high-quality resources. As described above, steam is used to turn turbines. The obvious drawback to this method is that underground water resources are finite, so unless there is a re-injection plant, the resource eventually gets tapped out. At The Geysers (which Ram Power, Polaris’s pre-bankruptcy entity, owned a project in) in California, the resource was almost completely depleted after about 20 years of geothermal power generation. Injection facilities have extended the resource life, but power generation isn’t to the extent is once was.

Binary Systems

Binary systems can accept significantly lower temperatures. Hot water is passed by an effluent with a high boiling point (butane or pentane) in a heat exchanger. The hydrocarbons then turn into vapor, which turns turbines, producing electricity.

Excess hydrocarbon vapor is collected and recycled within the system, resulting in extremely efficient use of the hydrocarbons. The cooled water is then pumped back underground to replenish the resource.

Because binary systems can be used on resources with significantly lower temperatures than flash-point systems, they have much wider usage potential.

System Efficiency

Thermodynamic efficiency (how much heat gets turned into work, which in turn produces electricity) of geothermal power varies significantly across projects, with some as high as 23% and some as low as 1-2%.

On average, binary cycles have efficiency of 10-12%, versus flash/dry steam efficiency of 7-10%.

San Jacinto

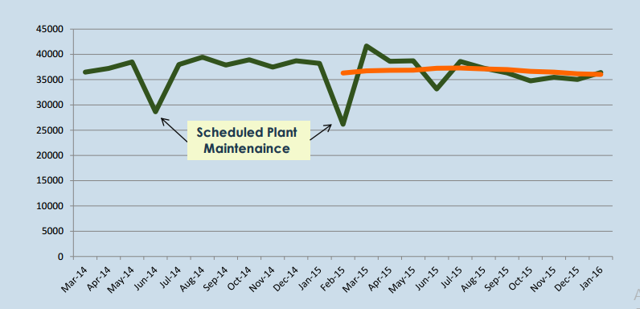

Polaris’ primary asset is its San Jacinto project, a 72Mw project covering 40 square kilometers in northwest Nicaragua. San Jacinto currently produces around 55Mw gross and 49.5 Mw net of power from 8 wells.

Of the 8 wells, 5 are a “closed loop” where water is put back into the reservoir. This is an important part of the project: a closed-loop system being implemented this early in the project helps avoid the significant production declines seen at The Geysers.

As is to be expected with geothermal, the variance of power production from the wells is quite high, ranging from 14Mw to 2Mw, with an average of 6.19Mw per well on a net basis (~7Mw gross).

San Jacinto generates significantly all of Polaris’ revenue via a PPA for up to 72Mw expiring in 2029 with Disnorte-Dissur, which is a subsidiary of Spanish utility TSK-Melfosur International. The PPA contains a 3% escalator for the next 7 years (until 2022) and 1.5% thereafter.

The San Jacinto project is also not exhibiting large declines. Part of this is due to the quality of the resource, and part due to the injection wells that Polaris operates.

Casita

The company also owns (in addition to a number of very small non-core assets which are being sold off) the Casita project, a potential 100+ Mw commercial scale project, also in Nicaragua.

Polaris has invested $11 million to date in the project, and the results so far look good: the first exploratory hole was drilled and found temperatures in excess of 230 degrees Celsius, hot enough for a dry steam facility.

In terms of financing, Polaris has significant cash on the balance sheet (discussed later), and has also been in negotiations with the World Bank for a ~$20 million debt financing for drilling to de-risk the project.

While a 100+ Mw project would be a multi-hundred million dollar project, there are a number of ways Polaris can de-risk the development. First, the company has arranged financing from the World Bank, as outlined above.

Second, there are potential synergies with the current drilling project at San Jacinto, where drills used at San Jacinto can be re-purposed at Casita. This results in some cost reduction from a drilling program at Casita.

Third, exploration and development of Casita can be done with the existing corporate team, so there is no need to significantly expand overhead at the corporate level in response to the expanded production.

Finally, because geothermal plants can be built well by well, the construction can be done modularly, much as San Jacinto has been. The first wells will be financed with outside capital, but once they generate cash flow, it is possible that Casita can expand on at least a partially self-financed basis. Obviously, this doesn’t reduce the development risk, but it does reduce the strain that a large development project could place on Polaris’ balance sheet.

Nicaragua

Nicaragua has had a checkered past, full of dictatorship, strife, and violence. In this sense, it fits in with much of Central America.

In recent past, the most notable change for Nicaragua has been the multiple elections of Daniel Ortega, who has served as president since 2007. Mr. Ortega is a noted socialist, and there are certainly legitimate questions about what his reign has done to the country’s democracy: under his leadership, the constitution has been amended to allow for unlimited 5-year presidential terms. He has also been supportive of FARC, Iran, and Gaddafi. Clearly, his sympathies lie with the more dictatorially persuaded among world leaders. President Ortega has, over time, tightened his grip on the country’s political system, and should, for all intents and purposes, be regarded as a dictator.

With regard to capitalism, President Ortega has said it was a mistake to privatize the telecom and energy industries, frequently rails against capitalism, and on the surface, seems to have positioned Nicaragua as a high-risk investment locale.

Despite this, the country is relatively open economically. It allows for 100% foreign ownership in most sectors, guarantees equal treatment with domestic investors, and allows for repatriation of profits.

Nationalizations, which were rampant in the 1980s, have largely ceased, and roughly 4,800 of 28,000 property seizure cases have been settle in courts, indicating that the government wishes to work towards a more fair treatment of property rights.

The legal system is considered to be very corrupt. As such, many contract disputes and other business disputes are more easily resolved by locals with connections and the funds to grease the system. This places foreign investors at a disadvantage.

With regard to renewable energy specifically, Nicaragua gets high marks. Because 25% of the country has no access to the grid, power generation is an important goal for the government, which has invested upwards of $400 million in improving its grid.

Additionally, Nicaragua has said it plans to generate 90% of its electricity from renewables by 2020. This stated goal fits with the country’s plan to expand its grid and promote its own development.

Because of Nicaragua’s corruption and poverty, it requires foreign capital for many of its development needs (for example, a canal to bisect the country and link the Pacific and Atlantic is largely financed by the Chinese). Because of this, there is a limit on what restrictions they can put on business, particularly with regard to nationalization.

Specifically, Polaris’ San Jacinto project is viewed as a showcase project for the country: it represents one of the largest foreign energy investments to date, and so the government has a strong interest in allowing Polaris to continue unencumbered.

Similarly, with the World Bank close to funding the Casita project, the government has a significant interest in making sure the project isn’t nationalized or significantly impeded by regulation or corruption.

Given the incentives of the Nicaraguan government, coupled with the unique circumstances of Polaris’ projects, we see little risk of nationalization or significant government activity placing Polaris at risk. That being said, investors should continue to monitor the situation in the country closely.

A Little History

Polaris is the result of a massive restructuring of Ram Power which significantly cleaned up the old company’s balance sheet. It is worth noting that Ram’s troubles came largely from its balance sheet: the operating assets were, and are, quite attractive, but development problems, cost overruns and poor financial management effectively doomed the company.

In May 2015, the company engaged in a private placement at $8 per share, raising $72 million. As part of the restructuring, its warrants were wiped out, and $53.016 million of 8.5% senior secured debentures were converted into 546,584 shares at $10.

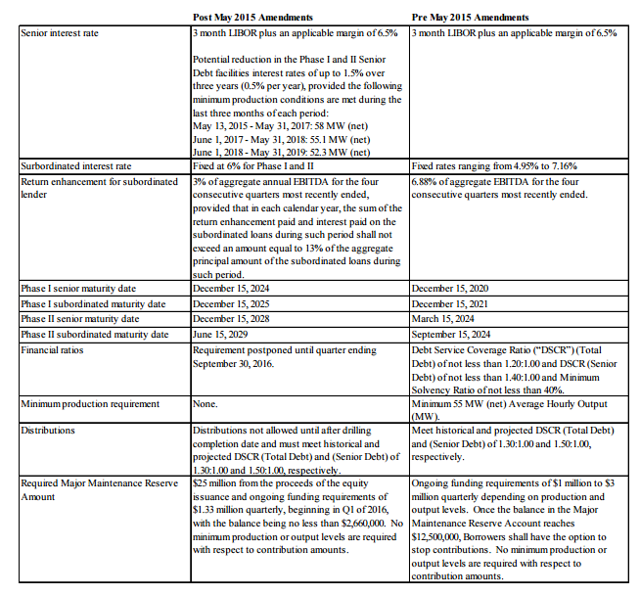

Its senior debt (all of which is project level) was also amended. Senior loans ($amount) have interest rates of 6.5%, with the potential to reduce rates up to 1.5% per year over 3 years, provided the company is able to meet production targets of 58Mw by May 2017, 55.1Mw by May 2018 and 52.3Mw by May 2019.

The subordinated interest rates are fixed at 6%. Subordinated lenders also get 3% of annual aggregate EBITDA for the 4 previous quarters. This performance incentive is capped at 13% (i.e., interest on the subordinated loans plus incentive cannot exceed 13% of the principal amount of the subordinated loans).

Financial ratio covenants were postponed until the quarter ending September 30, 2016. Previously, these were a DSCR of no less than 1.2 for total debt (1.4 for senior debt) and a minimum solvency ratio of not less than 40%.

The required maintenance reserve was also increased. Originally, it was $1-3 million per quarterly, with a cap of $12.5 million. As of the restructuring, $25 million was put into the reserve from the equity issuance, and ongoing funding is required to be $1.33 million per quarter, with the balance of the account not dropping below $2.66 million.

Additionally, the company’s leadership was reconstituted, with Marc Murnaghan, Jorge Bernhard, and Jaime Guillen being added to the board, and Marc Murnaghan being appointed CEO.

The net result of the restructuring was a significant increase in the company’s flexibility, which now sets it up for significant success.

Financial Overview

Income Statement

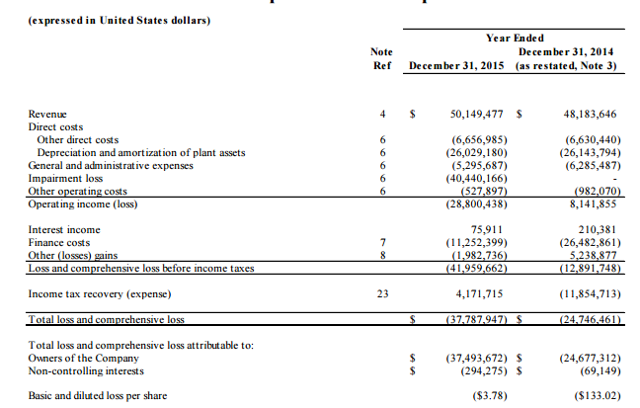

Polaris’ financial picture has improved remarkably over the past year.

While on paper the loss has expanded, there are 2 items that we would like to draw readers’ attention to.

The first is the $40 million impairment loss, which consists of a $39 million impairment on PP&E and a $1.5 million impairment on assets held for sale. This impairment loss, which was on the San Jacinto project, is completely the result of an increase in the discount rate from 11.3% to 13%, used to estimate the project’s value in use.

As readers should know, impairment losses are a non-cash expense, although they do tend to carry a tax benefit. Similarly, under IFRS, impairment losses can be reversed to the extent of the loss.

The second item is the $11 million of finance costs. This number compares to $26 million in 2014, showing the significant improvement as a result of the restructuring.

Cash Flow Statement

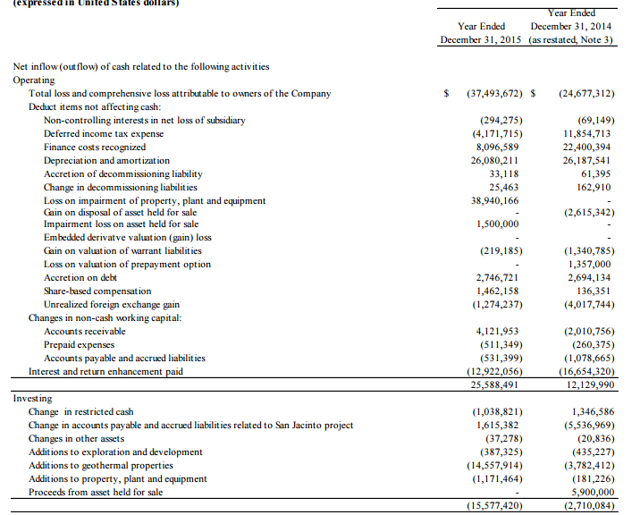

What is more important than the income statement, however, is the cash flow statement. We believe that the cash flow statement presents a significantly clearer picture of the actual economics of the company.

Again, we would like to draw readers’ attention to 2 items.

First, the cash from operations of $25.588 million. This represents a more accurate picture of the true earnings power of Polaris, as it adjusts for a number of non-cash items, such as accretion on the company’s debt, depreciation, and the impairments mentioned above.

Second, the additions to geothermal properties (i.e., capex) of $14.5 million. This is a significant increase from 2014’s level and is due to the company’s drilling program at San Jacinto.

On a normalized basis, Polaris expects $5.5 million of capex a year, which includes about $2 million a year of maintenance capex, and $10 million every 3 years (or ~$3.3 million per year) or so to drill for new wells to maintain production.

Balance Sheet

There are 2 main points we would like to draw readers attention to on the balance sheet.

First, Polaris has ~$61 million in cash. This is a result of the private placement the company did as part of its restructuring. This cash balance will be able to cover the proposed binary unit (~$30 million) and the completion of the company’s current drilling program (~$30 million). This flexibility to grow without needing to raise additional capital is a key part of the attractiveness of Polaris.

Second, debt has been significantly reduced from $246 million in 2014 to $171 million today. The reduction in debt, coupled with a reduction in interest rates places the company in far better condition today.

This increased financial flexibility frees the company to focus on what look to be attractive growth prospects.

Growth Prospects

San Jacinto Drilling Program

Polaris is currently in the middle of a 3-well drilling program at San Jacinto. This has the potential to add roughly 18-20Mw of capacity at the company, assuming its average well capacity of 6.19 Mw (net) holds true. As previously mentioned, the company’s results from wells are quite volatile, so this figure could be significantly higher or significantly lower.

The first well, SJ 6-3, is currently undergoing thermal recovery evaluation for a small, shallow reservoir. If the well is viable, the company will simply tie it into existing plant infrastructure, which wouldn’t be particularly capital-intensive. We estimate this well will add roughly 4-5Mw of capacity when finished.

The second well, SJ14-1, is still in the early stages, looking for confirmation of temperature and permeability of a deeper reservoir. If successful, this well will need the construction of a high-pressure steam separation station.

The third well, SJ9-4 is also in the early stages, targeting a shallow reservoir portion of an existing reservoir. If successful, this well could produce around 5Mw, based on results from existing wells into the same reservoir. Note that even though this well is still at early stages, because it is an addition to an existing known resource, it is relatively low-risk.

Binary Unit

Polaris also plans to spend ~$30 million to add a binary unit to San Jacinto. Because of the increased efficiency of this type of production, it should add between 10% and 12% to production, or about 6-10Mw, depending on production levels.

Adding a binary unit is free of exploration risk, and adds to the efficiency of future wells that are added to the plant, so there is significant potential for value creation from this addition.

Future Well Options

There are an estimated 10 other drilling sites that the company could explore. This is important, as future ability to explore an already developed site is a key way to offset decline rates in the existing resources.

Summary of Expansion Options

Between the binary unit and 3 new wells at San Jacinto, Polaris has the potential to add upwards of 30Mw (20 from drilling and 10 from the binary unit) to its existing ~50Mw capacity, which would mean the company would more than fill its 72Mw PPA. We estimate it would be able to achieve similar pricing for power sold on market today, though the agreements may be more risky (i.e., no escalator, shorter lives, etc.).

We will go over the effects of the expansion on valuation in the Valuation section.

Management Team

Key to Polaris’ ability to execute going forward is management’s skill set. We believe Polaris management and board possess significant experience, which will prove invaluable to the company going forward.

CEO – Marc Murnaghan

Marc joined the company just as Polaris finished its restructuring. Marc has significant experience in merchant and investment banking at Harrington Global Inc., where he provided growth capital to companies, and also at Cormark Securities, where he ran the Power and Alt. Energy group.

Marc’s experience proved invaluable to the company during its restructuring, as he led the negotiation of amendments to the San Jacinto project loan documents.

Because of the capital-intensity of expanding Polaris, a CEO with capital markets experience, particularly in the Alt. Energy space, is particularly valuable. Similarly, Marc’s experience in structuring transactions will prove useful.

CFO – Shane Downey

Shane joined Polaris Infrastructure in 2015 and was an MD with BMO Corporate Finance, where he was responsible for origination and structuring of mid-market senior debt financings across a range of industries. Prior to BMO, Shane spent the first 7+ years of his career with KPMG and PwC.

We believe having both a CEO and CFO with significant capital markets experience benefits Polaris immensely. On-the-ground operational experience is already present at the company, but what will add value over the long run are financing and capital allocation decisions, both of which we feel the CEO and CFO are qualified to do.

Further, it is worth noting both the CEO and CFO are well aware of what sunk the old company (poor capital allocation, cost overruns, and bad financing decisions), and should have learned from the mistakes of old management.

Board of Directors

The two changes to the board worth mentioning are the additions of Jorge Bernhard and Jaime Guillen.

Jaime joined the Board of Polaris Infrastructure in May 2015. Fluent in Spanish, Jaime is managing partner at Faros Infrastructure Partners LLC. He has 25 years of experience in equity investments, project finance, project development, commercial contract negotiations, and company operations in a variety of sectors including energy, transport, natural resources, private equity and fund management. His experience ranges from Europe, North & Latin America, Middle East, and Asia, and he has had significant dealings and experience with investors, developers, financial sponsors, governments, and various industry players. He has worked for major international firms, including as VP with Bechtel Financing Services, managing director of Bechtel Enterprises, CEO of Alterra Partners (a joint venture with Singapore Changi Airport). Jaime earned a BS in Nuclear Engineering from MIT (US) and an MBA from Stanford University.

The value that Jamie can add to the board should be obvious. As Polaris seeks to expand its footprint in Latin America, managing the mess of government regulation, capital markets, project financing, and engineering is an exceedingly complex affair. Jamie’s background gives him unique experience and insight into managing these complex projects.

Jorge joined the Board of Polaris Infrastructure in May 2015, coincident with the closing of the recapitalization transaction. He is fluent in Spanish and has 25+ years of experience throughout Central America and the Caribbean, mostly via Canadian-based businesses. Jorge brings considerable experience to bear as Polaris Infrastructure seeks to grow operations in Nicaragua and elsewhere throughout Central America.

Having a second fluent Spanish speaker with experience navigating Canadian businesses through Central America is a significant benefit to Polaris.

Institutional Holders

There are 3 institutional holders we think are worth mentioning. First, Goodwood Inc. owns 11.5% of Polaris and was the primary force driving the company’s restructuring. Goodwood is one of the most successful Canadian hedge fund firms and often employs an activist strategy in its holdings. Having them as a large shareholder, we believe, is beneficial to other shareholders.

Second, both Vertex One Asset Management and PenderFund Capital Management are large holders. Pelorus’ founder, Peter Kaye, interned at PenderFund, and knows first-hand that Pender is a top-quality value shop. The fact that they are in Polaris is a good signal for shareholders.

Vertex One is also a well-regarded firm, and is amongst the largest Canadian hedge fund firms, run by very capable investors.

Valuation

We value Polaris using a base case, and then value each additional well at San Jacinto and the binary unit at San Jacinto separately.

San Jacinto Base Case

Operating Assumptions

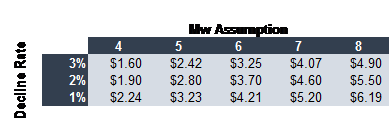

Revenue: Our revenue model assumes the company’s 2015’s production, subject to a 2% decline rate, equates to 48.76 Mw (net). This is slightly below the annualized run rate of 49.3Mw (net) through March 2016.

We assume a 2% decline rate going forward throughout the life of the model.

Last year’s pricing on the PPA came in at about $1.01 million per MW, and is subject to a 3% escalator this year, meaning $1.04 million per Mw in 2016. We continue this 3% escalator going forward, though readers should recall that in 2023 it will switch to a 1.5% escalator. We have built this change into the model, and it is the reason for the revenue growth declines starting in 2023.

Direct Costs: We assume direct costs of 13% of sales, in line with historical levels.

SG&A: Management has guided that an additional 20% of SG&A can be cut out of the company relative to 2015, largely as a result of lower legal and other administrative costs, many of which have already been realized. The SG&A run rate for Q4 2015 was $1.23 million, or $4.92 million annualized, versus SG&A costs for FY 2015 of $5.3 million. We assume SG&A for 2016 will come in around $4.75 million and will remain around 9.5-10% of sales.

D&A: We take the company’s current assets and depreciate them on a straight line basis over a useful life of 12 years. Capex feeds into the depreciation schedule as an asset, which is subsequently depreciated.

Capex: We assume there is no drilling for expansion at San Jacinto going forward, which means capex comes in at management’s guidance of $5.5 million. We assume some buffer and increase that to $5.65 million in each year.

In the final year, capex is set equal to depreciation to allow for a proper terminal value calculation, as throughout the life of the model, capex is less than depreciation. This obviously can’t continue into perpetuity, as the asset would depreciate to $0 at some point without capex making up for depreciation.

Interest Expense: We tie interest expense to the company’s amount of debt on its various credit lines. These bear a current weighted average interest rate of 7%, but as outlined in the section on Polaris’ restructuring, there is room for these rates to fall. We assume the company’s interest rates decline from 6.6% currently to 5.5% in 2018.

We also factor in the company’s mandatory repayments on its current debt into our valuation. These are given below:

The combined effect of the reduction of interest expense and the reduction in overall debt levels is a significant increase in profitability for the company. The results can be seen below:

We should note here that we assume no debt is paid down in the final year of the model. This is to normalize free cash flow for the terminal value calculation.

Valuation Outputs

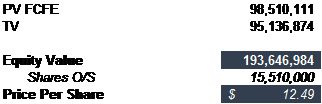

The results of the above assumptions are summarized in the below table. Note that this is the valuation for San Jacinto alone, and it is a free cash flow-to-equity valuation, which takes into account the company’s paydown of debt.

WACC Assumptions

Our WACC assumptions are given below:

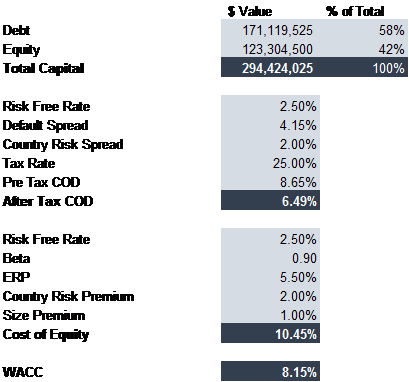

Value of the Binary Unit

Recall that Polaris has the ability to add a binary unit to its operations at San Jacinto. This would have the capacity to add between 6-10 Mw of capacity, which is in line with the fact that binary units are about 10-15% more efficient than flash steam units.

Note that if the project adds 10% to baseline production currently, that means the binary unit is generating 10% of 50Mw, or 5Mw of capacity. We use this method to calculate revenue for our NPV calculations.

We value the binary unit as a single project on an NPV basis. We assume the unit costs $30 million, and assume the project is 70% debt-financed, which is what management has indicated lenders would be willing to finance.

We assume an after-tax cost of debt of 6.5%, and since the debt will be senior, a term of 10 years over which the debt is amortized. Interest is calculated each year on the balance of debt outstanding.

We assume direct costs are in line with the current costs at the company’s existing operations, and that the binary unit has a useful life of 25 years. We assume depreciation is equal to the required maintenance capital expenditures.

Note that the production capacity of the binary unit will vary depending on the production levels of the existing plant, so the value of the binary unit depends on your assumptions of base Mw production. The results are summarized below:

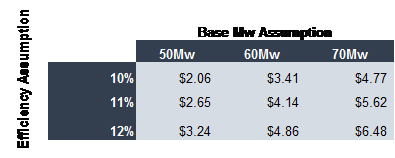

Value of Each Well

Each well, we assume, costs around $10 million to drill and has salvage value of $1 million, with a 20-year useful life. We assume the company finances wells with 100% equity at a cost of 10.45%.

Direct operating costs are assumed to be in line with the company’s existing costs (~13% of revenues), and capex is assumed to be equal to depreciation each year. We assume decline rates of 2% over the life of the well.

On an NPV basis, the value will vary significantly depending on the output per well. The sensitivity analysis based on the above assumptions is included below:

It is important to understand that because the margins are so high on additional wells, they add huge amounts of free cash flow to the company.

Expansion Valuation Summary

We prefer to be conservative and estimate that the company’s drilling program will not be successful, with the exception of well SJ6-3, which, we estimate, will be a 4Mw well with declines at 2%.

This means the well adds $1.90 per share to Polaris’ valuation, with the resulting Mws at 54 (net). At this level, the Binary unit adds roughly $2.70 per share of value.

DCF Valuation Summary

We value Polaris at $12.49 per share, plus $4.60 of expansion opportunities, bringing the final value to $17.09 per share. We’ll be conservative and give Polaris a $17 price target, representing 105% upside to the shares’ close on April 13th, 2016.

Our valuation represents an EV of 9.5x 2016E EBITDA, which we feel is quite reasonable given the business, operating risks, management and asset quality, and cash flow profile.

The Dividend Situation

In its 2015 Annual Report, Polaris announced the initiation of a dividend of US$0.10 for the first quarter. The company intends to have a 50% payout ratio, which will allow for shareholder returns, but also keep capital for expansion inside the company. This represents an annual yield of 6% in CAD on the current share price of ~$8.25. Note that the dividend is paid in USD and the share price is in CAD, so we assume USD/CAD at ~$1.25, which, we feel, is fair value for the currency.

Our 2016E FCFE estimate is around $9.6 million, which is lower than Polaris’ guidance of $11 million. This is due to our conservative revenue assumptions and heightened capex assumptions. We assume $5.65 million of capex in 2016, and Polaris has ~$22.8 million of debt service due in 2016, split at $11.3 million in interest and $11.5 in obligated and voluntary debt repayment.

Looking forward, there is significant room to expand the dividend. Since every Mw adds ~$1 million to FCFE, the binary unit has the potential to add another $0.175 per share in dividends (5.4 Mw x $1 million = $5.4 million. $5.4 million x 50% = $2.7 million. $2.7 million/15.5 million shares O/S = $0.175 per share).

The additional 4Mw well also adds $2 million to distributable free cash flow, or $0.13 in dividends at a 50% payout ratio.

Additional wells can add to that number considerably. If, for example, the company is able to achieve 72Mw of production (filling its PPA), that equates to an additional $20 million in FCFE, of which $10 million is available for distribution, or $0.645 per share.

The fact the company has runway to increase its dividends and grow is a significant advantage for value investors: you get paid to wait. Because Polaris is small, has recently emerged from bankruptcy, and is still undergoing a transition where the financials still haven’t been cleaned up (e.g., a $40 million impairment), it is likely to remain under the radar for a while.

Catalysts

We believe there are a number of catalysts which will serve to close the gap between the current market price and fair value.

End of Bond Fund Selling

In the restructuring, funds that held Ram Power debt were given equity in exchange (this is the debenture exchange referred to earlier). Bond mutual funds are only allowed to hold a small part of their assets in non-fixed income assets, and as such, most of these funds have been liquidating their shares over the past year. This is the largest factor contributing to the decline in Polaris’ share price.

Once this selling pressure abates, which it should do shortly, the share price is likely to moderate.

Introduction and Increase of the Dividend

As laid out above, Polaris has already introduced a dividend. The 6% CAD yield is not spectacular, but it is very healthy, and we believe that will entice some buyers once it is more established.

Additionally, as outlined above, the company has significant ability within the next 2-3 years to increase its dividend. Adding 1 well of 4Mw and the binary unit of 5.4 Mw (both of which are conservative assumptions), that adds another $0.305 USD to the dividend, which would have Polaris yield $0.705 USD, or $0.88 CAD, for a yield of 10.6% at the current share price of ~$8.25, and 5.1% at our target price of $17.

Deleveraging the Company

The combination of reduced interest on the debt over time, and aggressive reduction in debt means the company will continue to delever over the next 2-3 years. This will reduce overall risk, which will likely reduce the yield required on the equity, which will cause the share price to rise.

Expansion of Production

Between the binary unit, additional wells, and the potential for exploration at Casita, Polaris has significant runway to expand the company going forward. This will feed into increases in the dividends, which we feel will be the primary driver of share price appreciation going forward.

Conclusions

Polaris offers the unique opportunity to invest in a company trading at a significantly depressed valuation for technical reasons (bond fund selling), while getting paid a 6% yield to wait. These sorts of situations don’t come along often, and when they do, you have to seize them. We are not alone in our estimation of Polaris – we count a number of top Canadian value investors as company in Polaris shares, and we are confident the stock will provide very attractive returns over the next 2-5 years.

Disclosure: I am/we are long RAMPD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.