Polaris Infrastructure Inc. Looks Much Better Now

Summary

Ram Power has changed its name to Polaris Infrastructure Inc.

Apart from changing its name, the company announced a radical restructuring process.

Today, Polaris is a totally different company; what’s more, the company, after many years of failure, could offer value to long-term investors.

This idea was discussed in more depth with members of my private investing community,Unorthodox Mining Investing.

Polaris Infrastructure Inc. (RAMPD) is a renewable energy company running a 72 MW geothermal plant in Nicaragua. The company was founded in 2008 as Ram Power Inc. but, after a radical restructuring, two weeks ago its name was changed to Polaris. Due to serious business and financial problems, the former Ram Power was not widely covered by the financial media. Now, after the major restructuring, the company looks much better. Therefore, in my opinion, it is the right time to remind investors interested in renewable energy about this pure geothermal play. In this article, apart from outlining some historical facts about the company, I want to discuss the last developments and their impact on the future of Polaris.

Current operations

Polaris operates only one geothermal plant, San Jacinto, located in northwest Nicaragua. The facility, with a capacity of 72 MW, started its operations in 2012. San Jacinto has a power purchase agreement (PPA) in place with the Nicaraguan power distributor Disnorte-Dissur. The PPA is expected to expire in 2026, but an extension of the agreement is possible.

San Jacinto is regarded as one of the best geothermal properties in Nicaragua. The estimated capacity of the entire project resource has a mean value of 277 MW so there is plenty of room to explore and develop this property.

The currently operating facility replaced the older geothermal plant, which was commissioned in 2005. Today’s power plant is a single flash facility of a net capacity of 72 MW. It was built in two stages:

- The first stage, with a capacity of 36 MW, was put into operation in January 2012.

- The second stage, increasing the overall capacity to 72 MW, was commissioned in December 2012.

The company has plans to develop the third stage of San Jacinto. This time, Polaris is going to increase the plant capacity by another 10 MW using a so-called binary unit. Due to the fact that this binary unit will use the geothermal fluids separated from the geothermal steam used to power the current plant, no additional production or injection wells will be required. Therefore, the expenditures to increase capacity are expected to be as low as possible.

Unfortunately, things at San Jacinto are not going smoothly because the plant is not generating as much electricity as planned. Let me cite an excerpt from the 2014 Annual Information Form (page 17):

“In addition, there is a requirement in the San Jacinto Project exploitation agreement that the amount of electricity generated by the plant be at least above a minimum prescribed amount. Until November 10, 2014, that minimum prescribed amount was 90% of the 72 MW (net)/day capacity of the plant. The Company has been experiencing resource declines in certain of its wells at the San Jacinto Project, and, as a result, has not been operating above the minimum capacity required by the exploitation agreement.

On April 18, 2014, the Nicaragua government agreed that the failure to meet the minimum capacity was a result of a force majeure and accordingly the Company has been relieved until May 31, 2016 from any penalties that would otherwise be applicable on account of the failure to meet the minimum electricity production.”

The company has been trying to remedy this situation. For example, between July 2013 and May 2014, an intensive drilling program was initiated to increase the available steam production. In effect, the capacity increased by 3 MW (net). But the problem is still not fixed, and therefore, an additional drilling program will have to be initiated once again (which will cost much more money).

In my opinion, it is a significant risk factor, casting a shadow over an investment in Polaris’ shares.

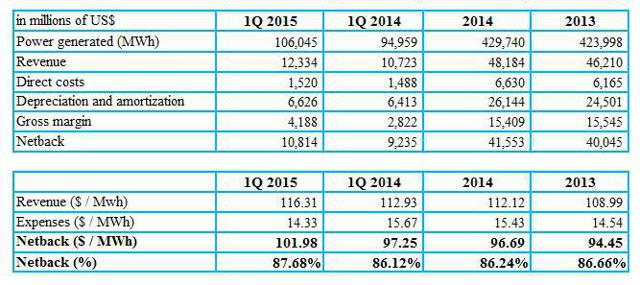

Now, a few words about the economics of the San Jacinto facility. In 2014, the facility generated 429,740 megawatt hours, which means that it was working at 49 MW per day on average (32% below its nameplate capacity). The table below summarizes some basic San Jacinto metrics:

source: Simple Digressions and Polaris reports

Let me discuss the main numbers.

Revenue – As I mentioned above, San Jacinto sells its electricity under a power purchase agreement which expires in 2026. In my opinion, it is a decent contract – the prices are quite similar to those realized in the US (for example, US Geothermal Inc. (NYSEMKT:HTM) sells its electricity for around $100 per megawatt hour). What’s more, a 3% increase in tariff is included in the agreement (as the table shows, in the first quarter 2015, the company received $116.31 per megawatt hour, which was 3% higher than a year ago).

Gross margin – It is calculated as: revenue – direct costs – amortization and depreciation. In the first quarter 2015, San Jacinto achieved a gross margin of $4.2 million, which was 48.4% higher compared to the first quarter 2014.

Netback – For me, this is an important indicator because it measures the efficiency of a facility. I calculate it as a difference between revenue and direct costs. Since 2013, San Jacinto has been demonstrating quite a high efficiency standing at around 87%. Let me remind you that the Neal Hot Springs, which is HTM’s best geothermal facility, regularly reports a netback of around 80%. Well, despite some technical problems, San Jacinto is a really decent power plant.

Other projects

Due to severe financial problems, Polaris has only one geothermal project, which is intended for further exploration and development. It has a property, called Casita, located in northwest Nicaragua. It is estimated that this project has the potential to build a 140 MW geothermal power plant.

Other properties, listed below, will be probably sold. Simply put, until the most recently announced restructuring, the company has been in urgent need for cash. For example, in 2014, Polaris sold the Geysers Project, an attractive geothermal property located in California. It was sold to US Geothermal for a fraction of cash spent on its exploration and development (Polaris got $6.4 million for this property but total expenditure amounted to around $90 million).

Properties for sale:

- Orita – A property located in California; Polaris spent $53.2 million on the Orita exploration and development

- Clayton Valley – The project is located in Esmeralda County, Nevada

- Delcer Butte, Reese River and Barren Hills in Nevada – non-core assets

- New River and Keystone in California – non-core assets

- South Meager Creek in British Columbia, Canada – non-core assets

A brief history of failure

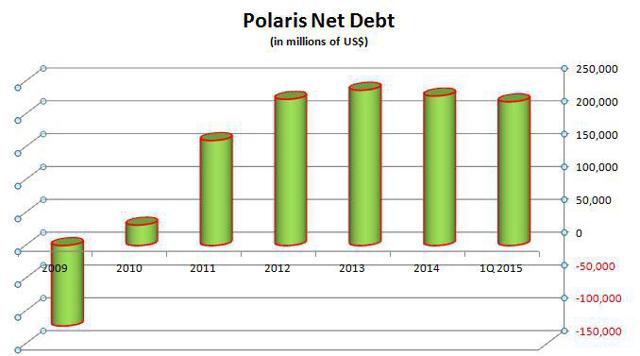

In 2011, Polaris entered a period of intensive construction of San Jacinto. A majority of the capital expenditure was covered with debt. The table below evidences the net debt of the company (defined as debt minus cash).

source: Simple Digressions and Polaris reports

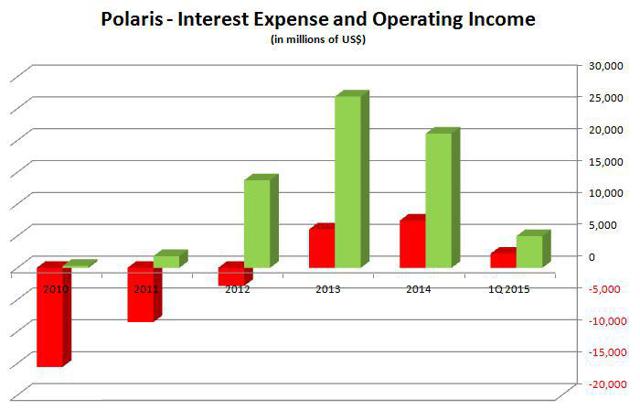

It is easy to spot that before 2011 the company had practically no debt. Then, between 2011 and 2013, the net debt increased to $236.7 million. What’s more, in 2013, Polaris reported interest expense of $26.9 million (in fact, the company spent $15.6 million in cash covering its interest expense). In comparison to operating incomes in the range of $6-$7 million per year (generated since 2012, when San Jacinto started selling electricity), the debt burden was too heavy. The chart below demonstrates interest expenses compared to operating profits starting 2010.

source: Simple Digressions and Polaris reports

I do not want to go too deeply into the history, but Polaris has tried many ways to get along with its debt. For example, the company issued debentures to pay off a corporate credit facility, paid part of its interest expenses with its common stock in lieu of cash, etc.

But, well, you cannot play financial tricks endlessly because Mr. Market uncovers all deficiencies – it is just a question of time. Polaris was no exception to this rule, and since 2011, the company’s share prices have been in a free fall.

And now comes the main part of this article.

Restructuring

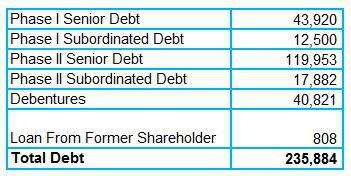

At the end of March 2015, Polaris carried the following debt (in millions of US$):

source: Simple Digressions and Polaris reports

Then, on May 14, the company announced that it completed the equity financing and recapitalization transaction. The main points of the above agreement were as follows (when recalculating Canadian dollars into US dollars I am using an exchange rate of C$0.8362 per 1 US$):

- Private placement offering of 18,598,500,000 subscription receipts for gross proceeds of approximately C$74 million – in effect the company got a fresh cash in the amount of $61.88 million.

- The company’s outstanding C$53,016,338 in aggregate principal amount of 8.5% senior secured debentures, together with approximately C$1,642,054 of accrued and unpaid interest, were converted into approximately 10,931,678,292 Pre-Consolidation Shares at a conversion price of C$0.005 per share – senior secured debentures of $45.71 million were converted into common shares.

- The company’s common shares have been consolidated at a ratio of 2,000 Pre-Consolidation Shares for each Post-Consolidation Share in the capital of the company. A total of approximately 31,026,418,906 Pre-Consolidation Shares were issued, which resulted in a total of approximately 15,513,157 Post-Consolidation Shares being currently issued and outstanding – currently there are 15,513,157 common shares outstanding.

- The board of directors of the company has been reconstituted to consist of five directors; Marc Murnaghan has been appointed as the CEO of the company.

Additionally, a binding agreement was entered into giving effect to certain amendments to the US$245 million credit facilities of the company’s wholly-owned subsidiary, Polaris Energy Nicaragua, S.A., which owns and operates San Jacinto.

“These amendments comprise:

- A revision of the payment schedule (including increasing the term of the credit facilities by four years);

- A reduction in the amount of capital required to be funded into each of the debt service reserve account and major maintenance reserve account on an ongoing basis;

- A potential reduction in the interest rates of up to 1.5% over three years; and

- The deletion of certain hourly output covenants and the postponement of certain financial covenants, all of which are expected by Ram Power to result in it being in a position to begin receiving distributions from PENSA in 2016.

The Company also expects that the effect of these changes will result in total debt service in 2016, inclusive of both principal and interest payments, being reduced to approximately US$22 million.”

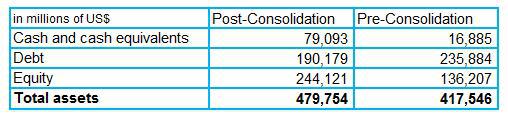

The company did not present the post-consolidation financial statements. Therefore, below I am providing the projected balance sheet after consolidation:

source: Simple Digressions and Polaris reports

As it is easily spotted, Polaris’ balance sheet should look much better after consolidation. The net debt of $219.0 million (at the end of March 2015) was translated into $111.1 million after consolidation. The ratio of Net Debt/EBITDA, a measure carefully studied by lenders, fell from 6.3 at the end of March 2015 to 3.2 after consolidation. As a matter of fact, this ratio is still not perfect but it is quite close to 2.5, which is regarded as a pretty safe one.

Ending this section, I have to mention that this transaction was very expensive to previous Ram Power investors – their holdings are totally diluted now. Before restructuring, these investors held 371.2 million shares of Ram Power – after conversion they hold 185.6 thousand shares of Polaris. Unfortunately, it is only a fraction of the company’s share capital (1.19%) so, simply put, they nearly lost everything.

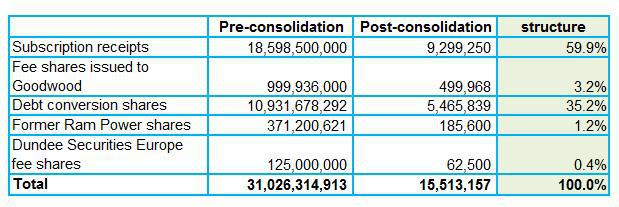

The table below presents the Pre- and Post-Consolidation capital structure:

source: Simple Digressions and Polaris reports

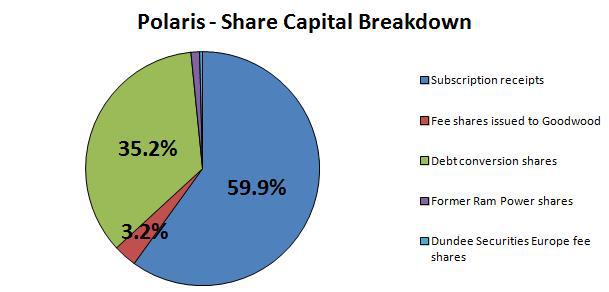

To make things clear, the chart below shows the current capital breakdown. It is easily spotted that the company is controlled by two groups of shareholders:

- Goodwood (a Toronto-based investment management firm responsible for the restructuring transaction) and undisclosed investors taking part in the private placement (59.9%); and

- Undisclosed entities, which were the owners of debentures issued by Ram Power in March 2013 (35.2%).

source: Simple Digressions and Polaris reports

Last but not least – as I have mentioned above, Marc Murnaghan has been appointed as CEO of the company. The fact that an investment banker (an expert in raising equity capital for renewable energy companies) is the key person in the company is a telling sign of ongoing radical changes.

Valuation

I realize that today it is a bit too early to make advanced assessments on the company’s value. Polaris has not published any strategy and financial plans for the nearest future. Despite this, let me present a simple valuation model, with a reservation that it is just a rough prediction, based only on the current operations.

The model is based on the following assumptions:

- Revenue growth of 3% per year (according to the power purchase agreement).

- Direct costs, depreciation and amortization, other operating costs are calculated as of the first quarter 2015 (multiplied by 4).

- General and administrative expenses account for 80% of expenses incurred in 2014 – the company decreased G&A expenses from $12.2 million in 2012 to $7.0 million in 2014 (a decline rate of 24% a year), therefore, I conservatively assume that in 2015 these expenses will decrease again, this time by 20%; then, in subsequent years, G&A expenses will be constant.

- Cash used in investing activities is equal to depreciation and amortization.

- I assume that net cash flow generated by the company in subsequent years, starting in Year 6, will be increasing at a rate of 3% per year.

- The company’s cost of capital is 6.53%.

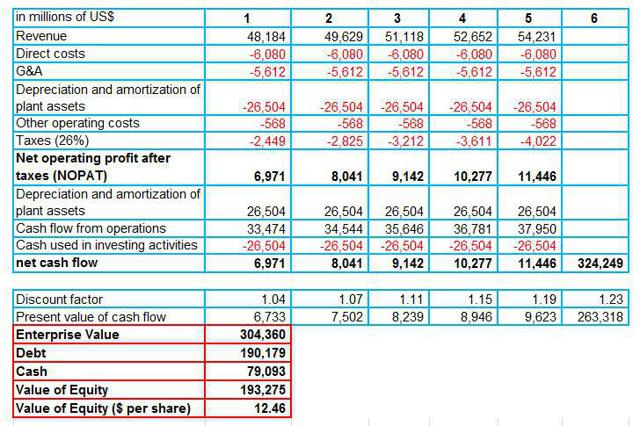

The table below presents my valuation model:

source: Simple Digressions and Polaris reports

As the table shows, the company’s equity is valued at $193.3 million, which means $12.46 per share. Currently, Polaris’ shares are trading at $10.41 a share, so they are presently undervalued by 16.5%.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.